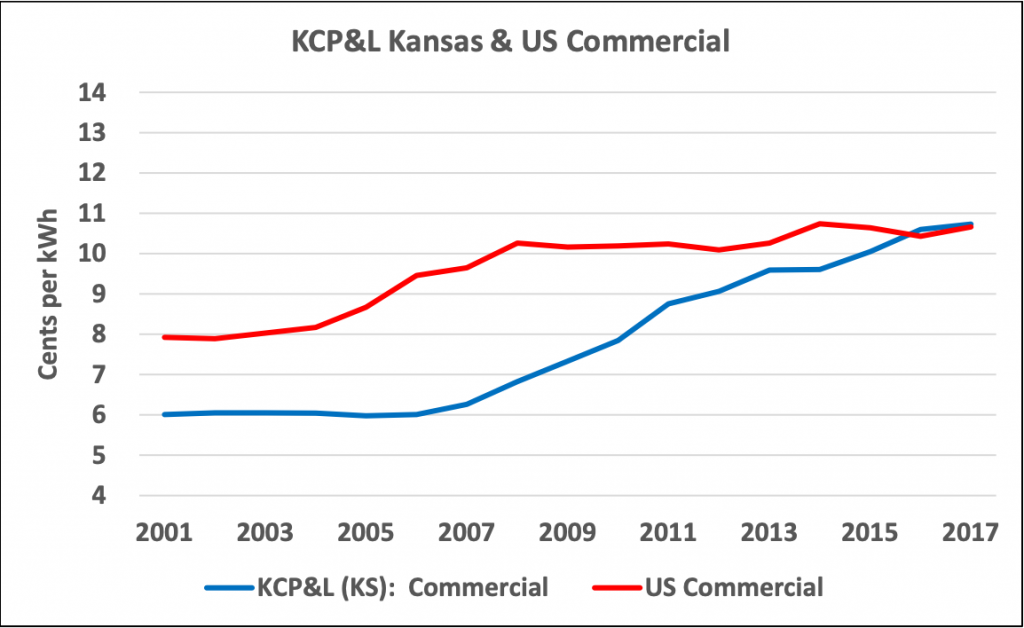

Utility costs in the Midwest that used to be among the lowest in the country have been quickly rising. Commercial utility rates are starting to outpace the national average as utility companies look to increase profits and pay for outdated grid maintenance.

Commercial real estate (CRE) property owners with Full-Service Gross Leases bear the brunt of these increases. But they have an exciting opportunity with commercial solar. Property owners and managers are constantly looking for ways to lower costs. Generating independent power with commercial solar reduces electricity costs and adds to their property’s value and marketability.

How does it work?

Installing commercial solar is not the same as residential systems. CRE owners should be aware there is a big difference in quality and performance between residential and commercial grade solar equipment.

The owner or manager starts by hiring a licensed commercial solar contractor, project developer, or EPC. Contractors like Artisun solar specialize in C&I properties, known for more complex energy profiles and usage than typical residential installs. Contractors, like Artisun, start by analyzing the business’s energy usage; we can reference 35,000 data points to create a custom-tailored system.

The system utilizes available square footage To offset as much energy as possible. Whether it’s rooftop, carport, or ground-mounted solar, only commercial specialists understand the unique factors at play for C&I buildings. The goal is to maximize the property owner’s ROI & NOI.

Most CRE owners want a “turnkey” service. It starts with planning, then moves to permitting, installation, and monitoring. Once the system is functional, the sun generates power throughout the day, offsetting the building’s usage. If the facility uses more energy than the solar is currently generating, it supplements from the grid.

CASE STUDY

The three-story office building in Kansas City, MO, annually uses over half a million kWh of electricity paid for by the property owner.

Artisun Solar installed a 150.22 kW system consisting of 406 solar panels. The system generates 207,270kWh annually, saving owners $19,529 in the first year alone. With Missouri’s steadily rising electricity rates, the building owner should conservatively save $851,584 in future electricity costs.

Using an average CAP Rate of 9% (actual rate unknown, estimated for scenario purposes), the commercial solar system adds $215,907 to the total property value.

Contact Artisun Solar today to discuss if solar is a viable option for your commercial property

There are multiple paths to ownership that we can explore when we sit down with you. Popular options include

Cash Purchase: The simplest option is always to pay cash for the system.

Self-Financing: Another option for the right borrower. Owners with strong financials self-finance through bank-backed debt. Owners with strong banking history may have more options for financing with more attractive terms.

3rd Party Finance: We have several financing options that require little or sometimes no upfront cost and remain cash-flow positive from day one. This type of financing is a great option for companies that wish to not layout capital.

BEST INSTALLATION PRACTICES

Make sure it’s turnkey: Property owners need to make sure the contractor or EPC they choose will provide complete service from start to finish. Commercial installations require much more upfront planning to design the appropriate system to meet the owner’s goals.

The process can be daunting; hiring a turnkey contractor will reduce the owner’s involvement and makes the process easier for everyone.

Use commercial grade: EPC’s, like Artisun Solar, specialize in C&I properties. The components and equipment used for each installation are unique to that specific property. One factor is constant; always choose commercial grade.

Design to be maintenance-free: Solar has no moving parts, so it’s relatively maintenance-free, but that doesn’t mean everything on your roof is. Accessing each panel should be easy, safe, and code compliant.

Inspect the roof structure first: For rooftop solar, the roof is the “foundation.” Older roofs need to be inspected for structural integrity. If a roof needs repair, it is best to bundle it with solar installation. In many cases, roof work can be included in the 26% Federal Tax Credit and financing options. Artisun Solar is not a tax professional, so clarifying with their tax advisor is highly recommended.

Design for the elements: Environmental factors like wind and snow loads should be included in the planning and design process, and this is where C&I specialists are valuable.

CONCLUSION

Commercial solar and other renewable technologies offer CRE property owners an opportunity to increase cash flow and property values. Like all good investments, the process requires a high level of due diligence, but the ROI and boost to your NOI are substantial.

The alternative is to continue paying increased utility costs. CRE owners are urged to at least explore the opportunity. Contact an Artisun Solar C&I specialist today.

Artisun Solar is a veteran-owned business dedicated to renewable energy solutions since 2011; we are focused on providing Commercial, Industrial, and Agricultural businesses a choice about paying for their energy. Artisun stands out from the competition by paying attention to the details. We have a better understanding of the local solar landscape, and we’ve seen every type of electrical service along the way.